Mobile devices and the internet of things have created unprecedented opportunities for developing world countries to move forward in the adoption of contactless payments.

This is becoming increasingly true as markets across Africa, Latin America and Asia are investing significantly in the improvement of their telecommunications infrastructure, providing the backbone for innovations in mobile payments.

The Leap Frog Effect

Leapfrogging describes the scenario in which areas with poorly developed technology or infrastructure move themselves forward rapidly through the adoption of modern systems without going through intermediate steps

Developing world countries are uniquely positioned in that they are not shackled by the constraints and complexity of legacy system infrastructure and can learn the lessons of developed countries without the research and development expense.

Appetite for mobile payments

We are already seeing this change unfold. In many developing countries such as those throughout Africa, mobile phones have a higher penetration than landlines and are used for banking, payments, money transfer, Internet, social media, etc. In some cases, broadband has higher penetration than roads. This can only assist in promoting these technologies to these less developed areas.

Mobile banking in particular has higher penetration than bricks and mortar banks in emerging markets. The unbanked in emerging markets are moving away from cash and leapfrogging conventional bricks and mortar banking. Instead, they have opted for mobile-based banking and payment services for processing deposits for wages and powering peer to peer transfers.

Other prominent examples of mobile payment systems include Pay TM in India and WePay and Alipay in China. These solutions have thrived off a peer-to-peer infrastructure and clever use of QR codes for cashless, proximity-based transactions. Their success is due largely to the ability to rapidly scale and implement new payment ecosystems across consumer mobile devices.

Switch to mobile payments

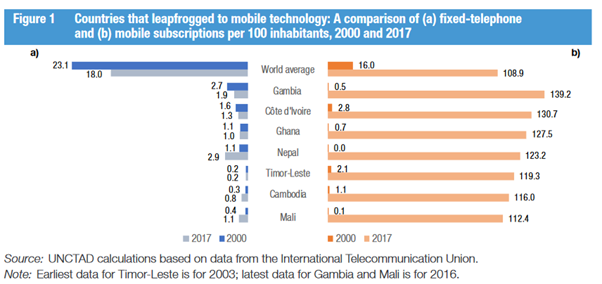

As the cashless economy accelerates, there is a risk that those most in need will be left behind. The World Bank’s latest statistics put the current global unbanked population at 1.7 billion in 2018. While this figure is down 800,000 from 2.5 billion in 2011, achieving a goal of zero unbanked citizens will be difficult if we rely on construction of typical bricks and mortar banks, as shown by the astonishing uptake of mobile subscriptions compared with fixed-telephone subscriptions below:

Innovators must look to mobile technologies and internet-driven solutions that enable the high scale, low cost ‘over the air’ rollout of new payment ecosystems.

Felix is perfectly placed to drive this innovation and facilitate the adoption of contactless payments: it is a software-only mobile point of sale solution (#SoftPOS), that can be installed onto existing handsets in minutes. Felix offers a cost-effective means for small businesses to take card payments on mobile – with Felix, people already have the payments terminal in their hand (their smart device) and can accept #mobilepayments instantly and securely. It also opens local markets to global consumers under the common EMV standards, set by Mastercard, Visa and other global card brands.

Watch this space!